This is good news for you as small claims are quicker and easier to process than large claims and you can represent yourself and will not need a lawyer. When you claim less than £10,000, which is common for unpaid invoices, it will be classed as a small claim by the courts. If your claim is less than the amount required to issue a statutory demand, or the debt is disputed, you will need to take legal action through the courts. If your client is running a profitable business, then they won’t want this to happen and issuing the statutory demand will force their hand. A statutory demand is generally effective because it can be the first step to winding up a company. There are no fees and you only need to complete one form. In order to issue a statutory demand, the debt needs to be undisputed and then the process is relatively quick and easy. You can issue a statutory demand if you are owed more than £750 by a company or £5,000 by an individual. You have two legal options to recover unpaid invoices. If you threaten legal action, you need to be prepared to follow through on your threat or you will never get paid. WHAT LEGAL RECOURSE DO YOU HAVE TO ENSURE YOU GET PAID If you don’t have the time to do it yourself, appoint a debt recovery specialist or collection agency to do the unpleasant work for you.

#FORCE PAYMENT OF OUTSTANDING INVOICES HOW TO#

One of the best tips on how to reduce unpaid invoices is to schedule a time each week for credit control and chasing up bad debtors. You need to make the time to ensure prompt payment for work that you have done, otherwise, you will go out of business. Claiming that you do not have time to follow up on unpaid invoices is not a good excuse to let people get away with not paying you and putting pressure on your cash flow. No matter how much you enjoy your job or having your own business, making money should be one of your main objectives. Regardless of what business you are in, credit control needs to be a priority. If you have upheld your part of the deal, your client needs to do the same, you are not running a charity. There really should be no excuse for unpaid invoices if you have supplied the goods or services you were contracted to. If necessary, you need to increase the severity of your warnings every time you contact them. You need to deal with and eliminate any excuses a client may have for not paying and make sure that they fully understand the implications if they don’t pay. No matter how big or small your business is, each and every stage of your company’s credit control process and procedure needs to bring you a step closer to getting your money. The first step to reducing unpaid invoices is to have an effective credit control system in place. Unfortunately, no matter how thorough your credit checks, how careful you are or how good you are at making time to send invoices and follow up on payments, you will probably have clients who don’t pay on time.

WHAT SHOULD YOU DO TO REDUCE UNPAID INVOICES Before you extend credit to any client it is important to do a credit check. If you want to encourage your clients to pay on time or make early payments, you could offer a discount.

#FORCE PAYMENT OF OUTSTANDING INVOICES PROFESSIONAL#

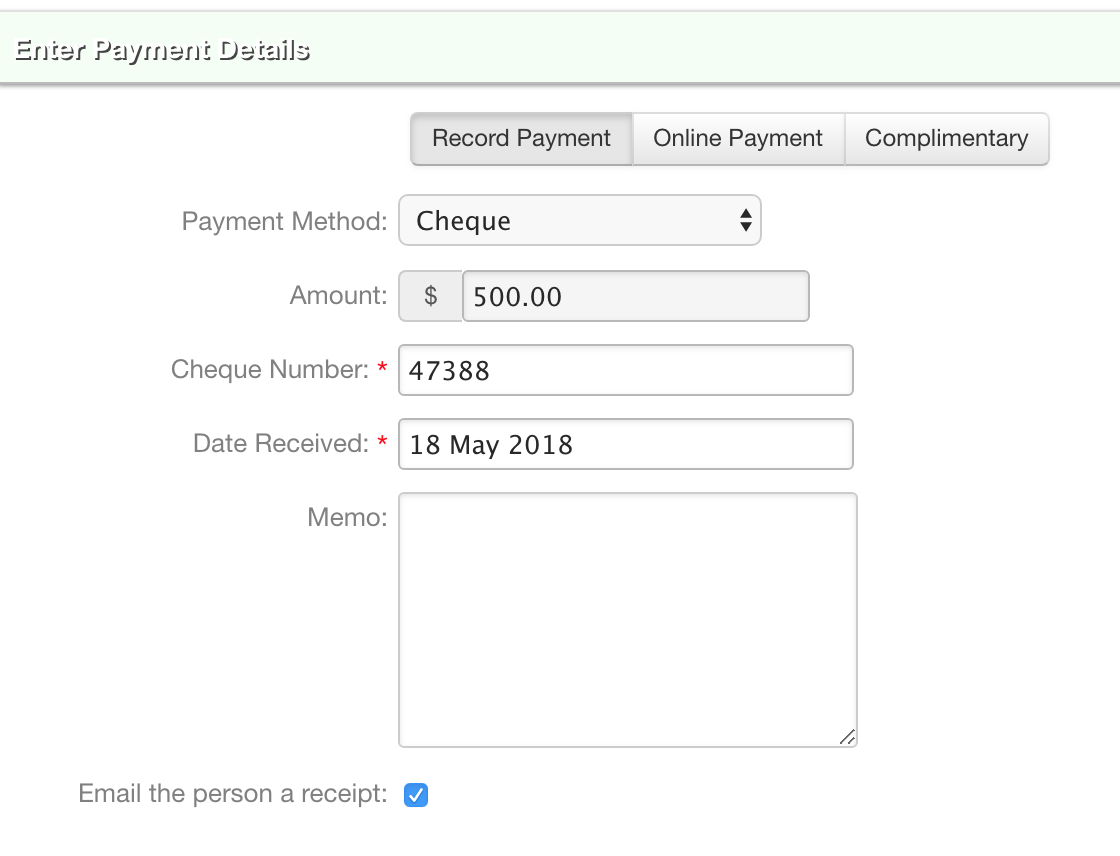

Your invoices need to look professional and should include payment terms, these are typically 30 days but could be 60 days. To ensure that you get paid on time, you must make time for sending your invoices and do not neglect this important side of your business. In order to get paid for the work that you do, the goods that you sell or the services that you provide, you need to invoice your clients correctly. If you are not doing everything possible to collect payment for work that you have completed or services you have supplied, then you are not fulfilling your duty as a company director. As the owner of a business or director of a company you need to take responsibility for recovering unpaid invoices and it is, in fact, your legal duty to act in the best interests of your company. There are a number of ways and tips on how to reduce unpaid invoices, and while chasing invoices is not fun or easy, it is, unfortunately, a common and necessary part of running a successful and profitable business of any size.

Debt collecting and chasing payments are not pleasant, but many business owners can and need to do more to limit the damage caused by unpaid invoices. Small businesses run on tight budgets and unpaid invoices and slow paying clients can have a devasting effect on your business.

0 kommentar(er)

0 kommentar(er)